Getting Paid in the Independent Economy: Insights From 400+ 1099 Workers

If there’s one thing we’ve learned over the past two years, it’s that the independent economy is here to stay. It will also only keep growing, as more workers leave traditional W-2 employment to create their own careers and follow their own paths.

While taking the reins of your own career isn’t easy, one of the biggest pain points for independent workers is the backend management of their work: calculating estimated taxes, finding good benefits, tracking expenses and dedications, and invoicing.

Much of this pain point is due to the lack of tools independent workers have that can help them — especially when it comes to generating invoices, sending them, following up non-payment, and tracking received income.

At IEC, our vision is to realize a world where workers are more independent, resilient, and free to choose their own path, on their own terms. That means having tools and resources to decrease their workload on the backend so they can spend time on doing the work they love.

This survey on “Getting Paid in the Independent Economy” not only gives us insights into what tools independent workers are using to invoice clients and how successful those tools are, but it will also give companies building tools for independent workers to better understand their challenges and needs so they can build better products for them.

Key Findings

Here are some of the insights we discovered about the invoicing practices of independent professionals:

74% of respondents are not getting paid on time. While 20% are getting paid in one day, 16% aren’t getting paid for two months or more, and those who include a “Remit by” date are still not getting paid within their requested time frame.

72% have outstanding invoices that have gone unpaid by clients. 59% are owed $50,000 or more for already completed work.

40% are using dedicated invoicing software. 38% create their invoices from scratch using Microsoft Word or Google docs. 21% use a fillable template they downloaded.

Only 52% say they’re “very satisfied” with their invoicing. Their dissatisfaction comes from tools not integrating payments, invoices taking too much time to generate, and other factors.

The majority are paying between $21 to $30 for their invoicing tool. 45% use a tool that costs $20 or less, and 28% pay over $20 for an invoicing tool. 17% use a free tool.

They would pay more for specific features. 67% who pay for a tool would pay more for certain features and 67% who don’t pay for a tool would be willing to pay if certain features were included.

They would pay for an invoicing tool that has the ability to calculate and pay estimated quarterly taxes automatically, and that can create and send invoices with email and mail a physical copy. They also would pay for an invoicing tool that accepts payments online securely and hassle-free, and one that tracks your payments and expenses to gauge profitability.

Table of Contents

Part 1 - Profile of Who We Surveyed

Part 2 - Invoicing Clients and Getting Paid

Part 3 - Invoicing Tools

Part 4 - Top Invoicing Tool Features

Part 5 - Companies Building a Better Future For Independent Workers

Methodology

On October 13, 2021 we surveyed 416 professionals in the US who earn the majority of their income from 1099 work and who directly invoice their clients. The survey was conducted online via PollFish using organic sampling through Random Device Engagement (RDE). Learn more about the Pollfish methodology here.

Part 1: Profile of Who We Surveyed

We surveyed 416 professionals in the US who earn the majority of their income from 1099 work and who directly invoice their clients.

Of our respondents 54.3% are on-call workers, like healthcare workers or substitute teachers, and 45.7% are independent consultants, like freelancers or independent professionals. We excluded those who work through platforms like Upwork and Freelancer.com, as well as gig workers, independent content creators, and independent merchants or sellers.

Of our respondents, 57.9% are male and 42.1% are female.

The majority (33.4%) are between the ages of 35 and 44. 13% are between the ages of 18 and 24, 28.9% are between the ages of 25 and 34, 11.8% are between the ages of 45 and 54, and 13% are over 54.

They’re lawyers, doctors, work in construction, marketers, accounts, and more

Our respondents do a variety of types of work, including lawyer (13.9%), doctors, dentists, or other medical professions (9.4%), construction, home maintenance, or landscaping (7.7%), marketers (6.7%), accountants (6.5%), and other work.

Nearly half became self-employed in the past year

24.8% have been self-employed for less than six months, and 20.4% have been self-employed between six and 11 months — 45.2%, nearly half of our respondents, who became self-employed during the pandemic. 20.9% have been self-employed between one and three years, 16.3% have been self-employed between four and six years, and 17.5% have been self-employed for over six years.

The majority are invoicing between $75,000 and $99,999

Our respondents are also very evenly split on how much income they invoice for. Over the past year, 20.9% invoiced less than $24,999, 13.5% invoiced between $25,000 and $49,999, 22.1% invoiced between $50,000 and $74,999, 22.4% invoiced between $75,000 and $99,999, and 21.2% invoiced between $100,000+

Section Summary:

This section simply shows that our respondents are incredibly different from one another. Some just started as independent workers, some have been self-employed for a long time. Some are invoicing for small amounts, some large amounts. They work in a diversity of professions. But the common element is that they all have a system of invoicing their clients, which we want to learn more about.

Part 2: Invoicing Clients and Getting Paid

Invoicing clients for payments isn’t necessarily new, but for those employed by a company and receiving a regular paycheck, it’s not something they have to worry about. For independent workers, however, it’s the only method through which they’ll get paid: generating and sending an invoice for billable work, and receiving payments remitted accordingly. How are our respondents going about invoicing their clients, through what methods, and how often?

62% are sending out over ten invoices per month

Our respondents are sending out a various number of invoices per month, which reflects the variety of professionals represented: patient-based, project-based, or daily work.

16.1% send out one to five invoices per month, 22.1% send out six to 10 invoices, 21.2% send out 11 to 15 invoices, 18.8% send out 16 to 20 invoices, and 21.9% send out 20 or more invoices. This means that 61.9% are sending out over ten invoices per month.

In terms of professional breakdown, lawyers, medical professionals, and those in construction are sending the most invoices per month (20+), while lawyers and those in construction (again), transcriptionists, and coaches are sending the fewest (1 to 5).

47% spend more than 6 hours per month creating invoices

As for time commitment, 27.3% spend less than one hour creating invoices per month, 26% spend one to five hours creating invoices, 23.6% spend six to 10 hours creating invoices, and 23.3% spend 10 hours or more creating invoices. These responses track to the responses above: The more invoices sent, the more time spent.

74% of respondents are not getting paid on time

Our respondents may be spending time generating and sending invoices, but are they actually getting paid on time? 26% of respondents say that three-quarter to all of their invoices are paid on time, while for 28.8%, half to three-quarters of their invoices are paid on time. For 21.2%, a quarter to half of their invoices are paid on time, and for 24%, less than a quarter of their invoices are paid on time.

If only 26% are seeing all of their invoices paid on time, that means that 74% of respondents are not getting paid on time.

20% are getting paid in one day, while 16% aren’t getting paid for two months

In looking at the time in which it takes to get paid, 20.4% are paid in one day, and 17.5% are paid in two to seven days — so, 37.9% are getting paid within a week. 14.2% are paid in one to two weeks, 17.8% are paid in three to four weeks, 14.2% are paid in five to eight weeks, and 15.9% are paid in eight weeks or longer.

Those who include a “Remit by” are still not getting paid within their asked timeframe

In looking further at time frames in which our respondents are getting paid, we found that for those who include a “Please pay upon receipt” on their invoice, the majority (28.4%) were paid within one day. However, only 25.6% were finding all of their invoices paid on time.

For those who include a “Please remit within 30 days” on their invoice, the majority (23.9%) were paid within two days to a week. However, only 26.1% were finding all of their invoices paid on time.

For those who include a “Please remit within 60 days” on their invoice, the majority were paid within one to two weeks (22.2%) or three to four weeks (22.2%). However, only 25.9% were finding all of their invoices paid on time.

This shows us that despite including a stated “remit by” timeframe on invoices, around three-quarters of invoices aren’t being paid by the requested timeline.

One follow-up typically results in payment

Unpaid invoices means lost income, so we wanted to know what our respondents were doing to track that income down. For 37.3%, one follow-up to the client results in getting an outstanding invoice paid. For 23.9%, it takes two follow-ups, and for 19.4%, it takes three follow-ups. 19.4% say they haven’t had to follow up on any outstanding invoices.

59% are owed $50,000 or more

Finally, how much are our respondents currently owed by clients, which can include current and overdue invoices? 26.2% are owed less than $24,999, 14.7% are owed between $25,000 and $49,999, 17.5% are owed between $50,000 and $74,999, 20.9% are owed between $75,000 and $99,999, and 20.7% are owed $100,000 or more.

Section Summary:

Our respondents are not only busy at what they do, but busy working to ensure that they’re getting paid, taking time to create and send out invoices — and the more invoices, the more time it takes.

However, while independent workers are doing their part, they’re finding that not all invoices are generating the payment they desire. In fact, 74% of our respondents are not getting their invoices paid on time — even if they’ve included “remit by” a certain date on their invoice. 72% have outstanding invoices still waiting to be paid, and they’re finding that they sometimes have to follow up upwards of three times to get it paid — which takes more time from their already busy schedule.

What we’re finding here is that the system isn’t as seamless as it should be, leaving many freelancers and independent professionals waiting on income, or leaving them unpaid.

Part 3: Invoicing Tools

Now that we understand the frequency with which our respondents are invoicing, how much they’re billing for, and when they’re getting paid, we wanted to better understand the invoicing tools they’re using and how satisfied they are with them.

40% are using dedicated invoicing software

When it comes to the method through which our respondents are invoicing, we found that 40.4% use dedicated invoicing software. 38.2% create their invoices from scratch using Microsoft Word or Google docs. 21.4% have downloaded a fillable template and use that.

Only 52% are very satisfied with their invoicing approach

Whether it be a dedicated invoicing tool, Word or Google docs, or a fillable template, is that method working? 51.7% say they are very satisfied with their current invoicing approach. However, 27.4% are only somewhat satisfied with their invoicing approach, and 20.9% are not at all satisfied at all.

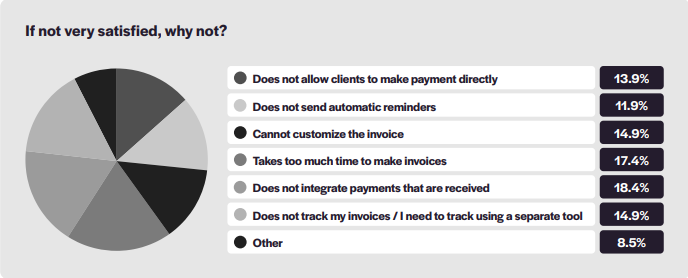

Dissatisfaction is due to payments not being integrated, invoices taking too much time to create, and other factors

For those who aren’t satisfied with their invoicing tool, they’re unsatisfied for a number of reasons, including:

Does not integrate payments that are received (18.4%)

Takes too much time to make invoices (17.4%)

Cannot customize the invoice (14.9%)

Does not track my invoices/I need to track using a separate tool (14.9%)

Does not allow clients to make payment directly (13.9%)

Does not send automatic reminders (11.9%)

Other (8.5%)

24% are paying between $21 to $30 for their invoicing tool

In terms of how much they’re paying for their invoicing tool every month, 23.8% are paying between $21 and $30 for their invoicing tool. 16.1% use a tool that costs between $1 and $5, 14.3% use a tool that costs between $6 and $10, 14.3% use a tool that costs between $11 and $20, and 14.3% use a tool that costs $30 or more. 17.3% use a free tool.

67% who pay for a tool would pay more

For those who are already paying for an invoicing tool, would they be willing to pay more if the tool offered certain features? 66.9% said yes, they would, while 33.1% said they would not.

67% who don’t pay for a tool would be willing to pay

Similarly, for those who are not paying for an invoicing tool, would they be willing to pay if the tool offered certain features? 66.7% said yes, they would, while 33.3% said they would not.

Section Summary:

Our respondents have to use some kind of tool or approach to invoice their clients. So how are they doing it? Only 40% are using dedicated software, while the rest are using Word docs, Google docs, or fillable .pdfs.

However, only half are very satisfied with the tools they’re using, as those tools just aren’t offering them the things that they need to conduct their business smoothly. This is why two-thirds of our respondents said that if offered the right features in their invoicing tool, they would pay more, or convert to paid if they use a free tool. In our next sections, we’ll examine those features they’re missing out on.

Part 4: Top Invoicing Tool Features

In our previous section, we discovered that two-thirds of our respondents would either convert to paid customers, or would be willing to pay more, if certain features were included in their invoicing tool. In this section, we asked what those features would be.

Respondents Would Pay More for These Top Features

In the above section, we found independent workers who were already paying for an invoicing tool. We wanted to know what types of features added to an invoicing tool would get them to pay more than they already were. Here’s what they replied:

Calculate and pay estimated quarterly taxes automatically (32.4%): Respondents would pay more for a tool that calculates and sets aside estimated quarterly taxes from each invoice paid.

Create and send invoices with email and mail a physical copy (17.3%): They would also pay more for a tool that creates a hard and soft copy for them.

Accept payments online securely and hassle-free (11.5%): While not as popular, they would also pay more for the ability to accept payments online, possibly as opposed to remitting payment through a physical check.

Respondents would also pay more for:

A tool with pre-made templates to create custom invoices (8.6%)

A tool that sends alerts, reminders, and notifications to clients (6.5%)

A tool that schedules appointments and bills the time by adding the appointment to an invoice (6.5%)

A tool that tracks payments and expenses to gauge profitability (4.3%)

A tool with automated invoicing workflows and billing cycle (3.6%)

Finally, 9.4% said that none of the features listed above would get them to pay more.

Respondents Would Convert to Paying Customers for These Top Features

Similar to above, we asked those who are using a free tool for invoicing what features would convert them to a paying resource? Here’s what they replied:

Calculate and pay estimated quarterly taxes automatically (25.4%): Respondents would pay for a tool that calculates and sets aside estimated quarterly taxes from each invoice paid.

Create and send invoices with email and mail a physical copy (18.1%): They would also pay for a tool that creates a hard and soft copy for them.

Track your payments and expenses to gauge profitability (9.7%): They would also pay for a tool that helps them identify how to be more profitable as an independent professional.

Respondents would also move from a free tool to a paid one for:

A tool that schedules appointments and bills the time by adding the appointment to an invoice (8.7%)

A tool with pre-made templates to create custom invoices (8%)

A tool with automated invoicing workflows and billing cycle (7.3%)

A tool that accepts payments online securely and hassle-free (7.3%)

A tool that sends alerts, reminders, and notifications to clients (7.6%)

Finally, 8% said that no feature offered would get them to pay for an invoicing tool.

Top Features by Importance to Independent Professionals

Finally, we asked our respondents to rank the features that would be most important to them in an invoicing tool. While the features mostly came out ranked evenly — which signals that they really need all of them — here’s the breakdown of features ranked by being most important:

Ability to calculate and pay estimated quarterly taxes automatically (47.1%)

Ability to create and send invoices with email and mail a physical copy (46.4%)

Ability Schedule appointments and bill your time by adding your appointment to an invoice (46.2%) and Ability to track your payments and expenses to gauge profitability (46.2%)

Ability to automate invoicing workflows and billing cycle (45.4%)

Ability to send alerts, reminders, and notifications to your clients (45.2%)

Ability to use pre-made templates to create custom invoices (44.7%)

Ability to accept payments online securely and hassle-free (43%)

Section Summary:

In this section, we learned about some of the features that independent workers want as part of their invoicing tools, features that will help them do business faster and more efficiently.

Both groups who would be willing to pay or willing to pay more said they wanted an invoicing tool that has the ability to calculate and pay estimated quarterly taxes automatically. It’s something W-2 workers don’t need to worry about, but that 1099 workers do: setting aside a portion of each paid invoice, and paying estimated taxes quarterly. They also both wanted a tool that can create and send invoices with email and mail a physical copy, which suggests that the tools they’re using now require them to do this manually.

Those willing to pay more also wanted an invoicing tool that accepts payments online securely and hassle-free, to help streamline their banking and assist in their accounting. And those willing to convert to paid customers wanted a way to track payments and expenses to gauge profitability, which is a beneficial business tool for their business of one.

But why should companies that work with independent workers build these features for them, outside of the fact that independent workers are willing to pay for them?

Part 5: Companies Building Invoicing Tools For 1099 Workers

We wanted to highlight some of the companies out there who are already providing invoicing tools for independent workers that will help them better track their billable services, and better manage their received income.

Wingspan is an app for freelancers that offers invoicing as one of its features, with personal pay links and automated payment reminders, and it tracks all invoices through one dashboard — it even holds aside taxes and pays them quarterly, too.

With FreeAgent, independent professionals and small businesses can use templates to create branded invoices, integrate online payments, and can set up automated invoicing, payment reminders, thank yous, and more.

Invoicely is not only a dedicated cloud-based invoicing tool, it lets users send estimates and client account summaries as well; it also tracks billable time and expenses, and can set up recurring invoicing as well.

As part of its all-encompassing automated CRM, Keap offers invoicing and “Pay Now” functionality, automated follow-up on unpaid invoices, tracking through a dashboard, and more.

An all-in-one accounting tool for freelancers, Momenteo offers the ability to send quotes and invoices, track income and expenses, and reconcile your account at the end of the month.

Indy allows independent workers to create custom invoices, including line items, hours worked, tax rate, and discounts, and offers automated invoicing, income tracking, and bank account integration.

Canopy is a management tool specifically for accountants that includes invoicing and tracking, and offers various payment plans for clients, including partial payments and recurring payments.

Independent workers use Invoice Berry to create custom invoices, set up automated recurring invoices, and to send invoices in different languages, all while tracking income and expenses on a dashboard.

Accelo is a business platform that manages sales, projects, support tickets, and invoicing, with customizable templates, automated billing, bulk invoicing, and more.

Aspire is a management platform built specifically for landscaping contractors, and includes electronic invoicing, accounting software integration, and insights into revenue and expenses.

For independent professionals like massage therapists and personal trainers who see clients, Bookedin offers appointment calendar management, invoicing, online payment integration, and more.

Brightwheel is a management solution specifically designed for childcare centers that offers in-app billing, invoicing tracking, mobile payments, and more.

Conclusion

What we’ve found from our respondents is that their current state of invoicing is sufficing, but it’s definitely not what it could be.

Some independent workers are satisfied with the way they invoice, but half are dissatisfied, feeling that they just don’t have the right tools to simplify the process. And it's not just the process of invoicing, but the process of waiting. Three-quarters of respondents deal with overdue payments and are following-up with clients upwards of three times to get paid, yet they are still waiting on outstanding invoices that haven’t been remitted yet — which is keeping money from their pockets.

And at the end of the day, no one is managing this invoicing and follow-up process but the individual freelancer, contractor, or independent worker. Workers in the independent economy have to manage their own business of one, so they’re on the lookout for ways to make it easier. This includes software and apps that can reduce the friction of invoicing, follow-ups, and payment integration, but that also helps them set aside and pay quarterly taxes, track deductions so they’re ready for tax time, and track expenses and revenues so they can see how their business is doing and how to improve it.

This is great news for businesses who are building these tools. There are 68 million independent workers out there who are looking for built-in features that can help them sustain and grow their work, and we found that two-thirds — which would equate to nearly 45 million independent workers — are willing to pay for those features.

This means that businesses looking for a waiting and willing market can step in and help the independent economy grow. As we’ve seen, there are businesses already out there taking advantage of this growing market. Will you?